Ramsey Tyson - A Practical Path To Financial Freedom

For many folks trying to get a handle on their money, finding a clear path can feel a bit like trying to find your way through a thick fog. So, what if there was a straightforward way to learn about handling your finances, getting rid of what you owe, putting money away, and making it grow? Apparently, a lot of people have found just that kind of helpful direction through the ideas put forth by someone widely known for giving sound financial advice. This approach has, in some respects, really helped countless individuals get a better grip on their financial lives, moving them from feeling overwhelmed to feeling pretty confident about their money decisions.

This whole idea, which many associate with the name Ramsey Tyson, is more or less about giving people the tools and the confidence to take charge of their own money story. It's not about complex economic theories or fancy stock market plays; it's about practical, everyday steps that anyone can follow. You know, it's about breaking down what seems like a big, scary topic into smaller, more manageable pieces that feel a lot less intimidating.

The core message, you see, is built on simple truths that have been shown to work for many different kinds of people. It’s about building good money habits, getting out from under the weight of bills, and then watching your money grow over time. This way of thinking has, for quite a while, been a guiding light for folks wanting to improve their financial situation, offering a fresh perspective on how to live with more financial freedom.

Table of Contents

- The Core of Ramsey Tyson's Financial Wisdom

- Who is Dave Ramsey? A Closer Look

- What Makes Ramsey Tyson's Approach Stand Out?

- How Does Ramsey Tyson Help People with Money?

- Is Ramsey Tyson's Advice Right for Everyone?

- Expanding Beyond Money - Other Areas Ramsey Tyson Touches

- Connecting with Ramsey Tyson's Community

- What's Next for Those Following Ramsey Tyson?

The Core of Ramsey Tyson's Financial Wisdom

The entire philosophy, often linked to the name Ramsey Tyson, centers on giving people a clear, no-nonsense plan for their finances. It starts with the very basics, like learning to create a spending plan, which is just a way of telling your money where to go instead of wondering where it went. Then, it moves into more pressing matters, such as getting rid of what you owe, which for many people, really feels like a huge weight lifted. After that, the focus shifts to putting money away for the future and making smart choices about where to put it so it can increase. This framework, you know, is all about helping people take back command of their cash, build up their assets, improve their leadership abilities, and make their personal situations better. It’s a pretty holistic view of well-being, actually.

Who is Dave Ramsey? A Closer Look

When people talk about the financial guidance often associated with Ramsey Tyson, they are, in fact, referring to the work of Dave Ramsey and the company he started, Ramsey Solutions. Dave Ramsey himself is pretty well-known; he's a person who has written a lot of popular books, hosts a popular radio program, and is considered by many in America to be a reliable voice when it comes to money matters. His journey began quite humbly, just on one radio station in Nashville way back in 1992, sharing straightforward answers to some of life's more difficult money questions. Today, his program reaches a huge audience, with over 18 million listeners tuning in each week across various platforms. So, his reach is quite broad, you might say.

Dave Ramsey - Personal Details & Bio Data

| Name | Dave Ramsey |

| Known For | Bestselling Author, Radio Host, Financial Advisor |

| Founded | Ramsey Solutions |

| Mission | Helping people regain control of money, build wealth, grow leadership skills, enhance lives |

| Key Program | The Ramsey Show |

| Signature Method | The 7 Baby Steps |

What Makes Ramsey Tyson's Approach Stand Out?

One thing that really sets the Ramsey Tyson approach apart is its directness and simplicity. It doesn't try to be overly complex or use a lot of confusing financial jargon. Instead, it offers practical, actionable steps that anyone, regardless of their current financial situation, can understand and follow. For instance, the core ideas are presented in a way that makes them feel very achievable, not like some far-off dream. It's about providing answers that people can use right away to make a difference in their everyday money situations. This commitment to straightforward advice, you know, is probably why so many people have found it to be a dependable source of guidance.

How Does Ramsey Tyson Help People with Money?

The way the Ramsey Tyson method helps people get a better grip on their money is pretty systematic. It starts with teaching you how to make a spending plan, which is essentially a way to manage your income and expenses. Then, it guides you through a process to get rid of any money you owe, especially things like credit card balances, which can really weigh people down. After that, the focus shifts to putting money aside for future needs and making wise choices about where to put those savings so they can grow. The whole idea is to give you a clear, step-by-step framework that, apparently, works for just about everyone who sticks with it. It’s about building up financial strength piece by piece.

The Famous 7 Baby Steps

At the heart of the Ramsey Tyson money management philosophy are the 7 Baby Steps. These steps are a bit like a road map for your money journey. They begin with putting aside a small amount for unexpected events, which is your first little cushion. Then, you focus intensely on getting rid of all your bills, which means paying off every single bit of money you owe, except for your house payment, if you have one. Once that’s done, you build up a larger emergency fund, enough to cover several months of living expenses. After that, you start putting money away for your future, like for retirement and your children's schooling. Next, you focus on paying off your home early. Finally, you get to build up your assets and give some of your money away. It’s not some kind of made-up story; it really does work every single time, people say.

Tools and Support from Ramsey Tyson

To help people along this path, Ramsey Tyson offers a variety of helpful items and services. For example, there's a program called Financial Peace University, which gives you all the main tools, useful content, and special benefits you need to handle your money the way Dave Ramsey suggests. You can also listen to or watch The Ramsey Show and all the other programs on the Ramsey Network online without paying anything. This gives you a chance to hear advice on how to pay off what you owe, like credit card balances, and how to build up your wealth from someone many consider America's most trusted money guide. They're always adding more to what you get with a membership, too, which is pretty neat.

One particularly useful tool that many people find helpful is EveryDollar. This is considered a great way to make a spending plan with confidence, keep track of all your money movements, and get a better idea of how you're spending and saving your cash. It really helps you keep tabs on things. Beyond that, you can get popular books, other helpful items, and guides put together by people who are good at money, relationships, career growth, and leadership. It’s a pretty comprehensive set of things to help you out.

Is Ramsey Tyson's Advice Right for Everyone?

A question that sometimes comes up is whether the Ramsey Tyson approach is suitable for every person. While the core ideas are pretty universal—like spending less than you earn and getting rid of what you owe—the specific methods might feel more comfortable for some than for others. For instance, the emphasis on paying off all non-mortgage debt before investing heavily is a key part of the philosophy, and while many find this incredibly freeing, some people prefer a different sequence. However, the basic principles of living within your means and avoiding borrowing money are, you know, pretty sound for just about anyone looking to improve their financial standing. It’s about finding a system that resonates with your personal situation.

Expanding Beyond Money - Other Areas Ramsey Tyson Touches

While the main focus of Ramsey Tyson's work is, naturally, on money, the guidance actually extends into other parts of life. The organization believes that good money habits often go hand-in-hand with a more well-rounded existence. For instance, they offer resources and insights on building stronger relationships, growing your professional skills, and becoming a better leader. Rachel, who is connected to the Ramsey Tyson team, writes and speaks on personal finance, but also on investing and current money trends, showing that the topics covered are quite broad. It's about seeing money as a tool that supports a better life overall, not just an end in itself. So, it's pretty integrated in that sense.

Connecting with Ramsey Tyson's Community

A big part of what makes the Ramsey Tyson method effective for many is the sense of community and shared purpose. When you're trying to make big changes with your money, having others who are on a similar path can be incredibly motivating. You can listen to or watch The Ramsey Show, which is a great way to hear stories and get advice from others who are also working through their money issues. The online presence of Ramsey Solutions also makes it easy to connect and get support. They use certain tools to make sure you have the best online experience, which helps them collect information about your time on their website and share it. This helps them improve what they offer, making the community experience even better. It’s about feeling like you’re not going through it alone, which is, you know, really helpful.

What's Next for Those Following Ramsey Tyson?

For those who decide to follow the path often associated with Ramsey Tyson, the journey doesn't just stop once you're out of debt or have an emergency fund. It's really about building lasting habits that lead to long-term financial peace. The continuous addition of new content and perks to memberships means there's always something fresh to learn or a new tool to try. Whether it's through listening to the shows, using the budgeting app, or reading the books, the goal is to keep you moving forward. It’s about staying on track and continuing to make smart choices with your money, which, as a matter of fact, can feel pretty empowering.

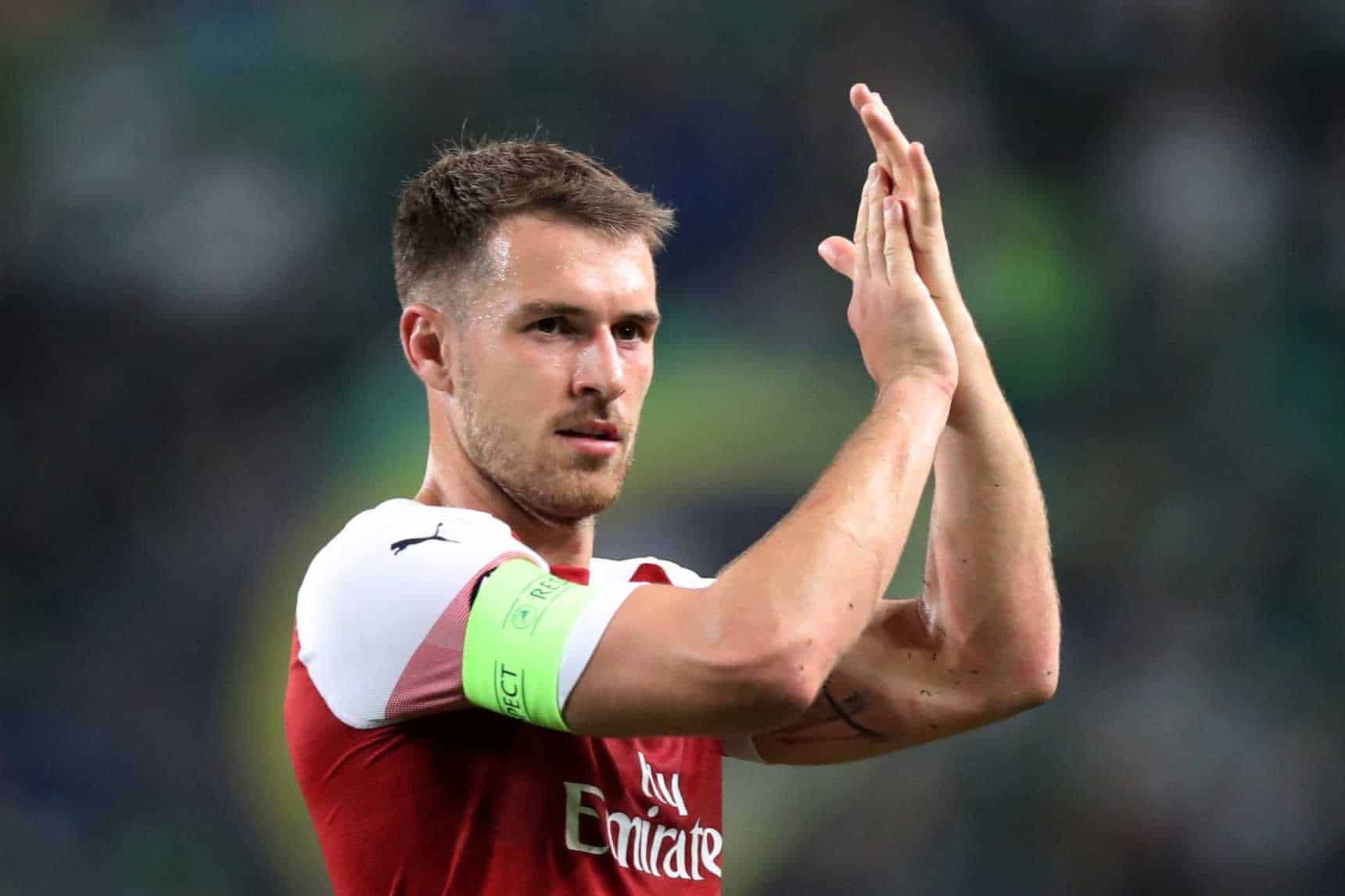

Aaron Ramsey Wallpapers - Wallpaper Cave

Arsenal's Ramsey signs four-year Juventus deal - Sports - Business Recorder

EPL: Ramsey set to join Juventus for free at the end of the season